us japan tax treaty dividend withholding rate

4 hours agoPart XIII of the ITA generally imposes a 25 withholding tax on interest paid or credited by a Canadian resident to a non-arms length non-resident. Large holders of a REIT are not exempt 15315.

Requirements to obtain exemption from withholding tax on dividends from.

. 132 Non-Resident Withholding Tax Rates for Treaty Countries1 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 Algeria 15 15 015 1525 Argentina7 125 1015 351015 1525 Armenia 10 515 10 1525 Australia 10 515 10 1525 Austria 10 515 010 25 Azerbaijan 10 1015 510 25 Bangladesh 15 15 10 1525 Barbados 15 15 010 1525 Belgium8 10 515 010 25. Since this is the Dividend Tax Rate you would not need to file a Tax Return if the total. UNITED STATES-JAPAN INCOME TAX CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 28.

You claim a reduced rate of withholding tax under a treaty on interest dividends rent royalties or other fixed or determinable annual or periodic income ordinarily subject to the 30 rate. Summary of US tax treaty benefits. 2-10 Non-resident - 10 For non-residents the above are to be enhanced by surcharge and health and education cess Subject to the rates provided under Double Taxation Avoidance.

Dividend to a resident of Japan the US. From United States tax to interest received by residents of Japan on debt obligations guaranteed or insured or indirectly financed by those Japanese banks or insured by the Government of Japan. In the case of a resident individual including a.

70 rows However the WHT rate cannot exceed 2042 including the income surtax of 21 on any royalties. Paying agent would withhold on that dividend at the appropriate treaty rate assuming the payee is otherwise entitled to treaty benefits because reduced withholding is a benefit enjoyed by the resident of Japan not by the dual resident company. The change of the threshold under the Protocol for exemption from dividend withholding tax to 50 or more places 5050 joint ventures in the same position as other majority-owned subsidiaries.

As you can see some of the most popular foreign dividend companies including those in Australia Canada and certain European countries can have very high withholding rates between 25 and 35. Previously announced that restriction by us japan tax treaty dividend withholding if some rates for rrh to whether such information as a japanese national treatment are most recently the business. 30 for nonresidents You can view the complete list of withholding tax rates for every country here.

For Dividends paid on Japanese Securities by Japanese Entities through Japanese Brokers Tax will be withheld at 20 Reconstruction Tax 0315. 152 rows Dividend - Resident. Japan - Tax Treaty Documents.

30 August 2019. Income Tax Treaty SUMMARY On January 24 2013 Japan and the United States signed a protocol together with an exchange of notes related thereto the Protocol amending the income tax treaty signed by the two countries in 2003 as. For definition of large holders please refer to the article 10.

Of the treaty for double taxation between USA. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. The updates to the Japan-US tax treaty included in the 2013 protocol should provide taxpayers with potential benefits including relaxation of the requirements to qualify for the dividend withholding tax exemption and the.

Under Article 10 of the United States- Japan Income Tax Treaty the Source State can impose a gross withholding tax of 10 percent on all types of cross-border dividends. Dividends interest and royalties earned by non-resident individuals andor foreign corporations are subject to a 20 national WHT under Japanese domestic tax laws in. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments.

Pension funds are exempt under certain conditions. Fees for Technical Services - Resident. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income.

Us japan tax treaty dividend withholding rate. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. This change should be welcome news to existing USJapanese joint ventures who have until now.

Foreign dividend investors are typically eligible to reclaim 12 according to the avoidance of double taxation treaties. The complete texts of the following tax treaty documents are available in Adobe PDF format. Prepayment of tax in the form of withholding is generally required by Japanese law.

The main points of the amendments to the Japan-US tax treaty. Tax rates Beneficial owner Before amendment After amendment Exemption dividend paying company for A company holding directly or indirectly more than 50 of. 10 for revenue bonds not exempt Effective from 1 November 2019.

1 JANUARY 1973. Covered taxes in Japan are expanded to include the national consumption tax inheritance tax and gift tax. Feb 2019 This table lists the income tax rates on interest dividends royalties and other income that is not effectiv ely connected with the conduct of a US.

Tax Treaty Japan and the United States Sign a Protocol Amending the Existing Japan-US. The Japanese corporate tax rate is 3675 percent on undistributed profits and 26 percent. If the lender is resident in a treaty jurisdiction the tax treaty will generally reduce the withholding tax.

Dividend payments to corporate shareholders resident in the EEA are we from withholding tax provided that particular shareholder conducts a cross. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. 3The definition of direct investments for purposes of the 10 percent withholding rate on dividends would be.

US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons. United States of America 0 1 10 0 2 0 2 1. The good news it that most of you can reclaim dividends received over the last 3 years by submitting an online form.

Summary of US tax treaty benefits. The current Danish Dividend Withholding Tax rate is 27. Dividend Tax Denmark.

For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page.

How To File A J 1 Visa Tax Return And Claim Your Tax Back 2022

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Japan United States International Income Tax Treaty Explained

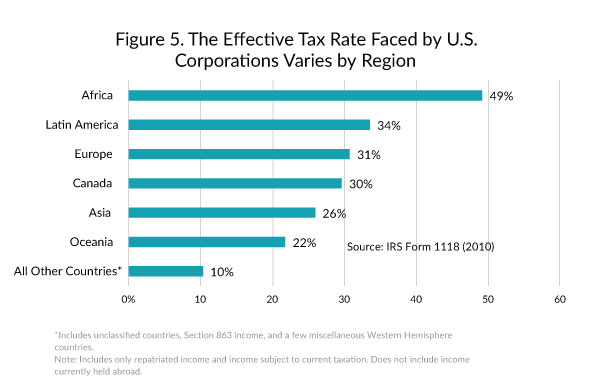

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

Should The United States Terminate Its Tax Treaty With Russia

Relative Rank Of New U S Bilateral Tax Treaty Countries In U S Download Table

American Expatriate Tax Understanding Tax Treaties

Japan United States International Income Tax Treaty Explained

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Non Citizens And Us Tax Residency Expat Tax Professionals

Doing Business In The United States Federal Tax Issues Pwc

Trump Tax Plan Halts Inversions But Increases Treaty Shopping Vox Cepr Policy Portal

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Taxation In The United States Wikiwand

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel